pay utah withholding tax online

This section discusses methods for filing and paying your taxes including how to file onlinethe fastest and safest way to file. According to Internal Revenue Regulations supplemental pay tax withholding may be calculated by applying the employees withholding rate from the Form W-4 on file or utilizing the flat rate withholding method currently 28 federal plus 6 for Utah.

Kiplinger Tax Map Retirement Tax Income Tax

See also Payment Agreement Request.

. Register with the Utah State Tax Commission. Use the menu for information on specific topics. You may also pay with an electronic funds transfer by ACH credit.

Unemployment Insurance administered by the Utah Department of Workforce Services. Register with the Utah State Tax Commission. Online payments may include a service fee.

WithholdingTax Payment Instructions You may pay your Utah withholding tax. Withholding Tax Payment Instructions. If you are required to make deposits electronically but do not wish to use the EFTPS.

This EFTPS tax payment service Web site supports Microsoft Internet Explorer for Windows Google Chrome for Windows and Mozilla Firefox for Windows. You may pay your Utah withholding tax. Interest is assessed on unpaid tax from the original filing due date until the tax is paid in full.

You may prepay through withholding W-2 TC-675R 1099-R etc payments applied from previous year refunds credits and credit carryovers or payments made by the tax due date using form TC-546 Individual Income Tax Prepayment Coupon or at taputahgov. Utah Taxpayer Access Point TAP TAP. View All New Hire Options.

You can pay taxes online using the EFTPS payment system. Online at taputahgov through a bank debit e-check or a credit card or By sending your check or money order payable to the Utah State Tax Commission along with the coupon below to. Utah State Tax Commission 210 N 1950 W SLC UT 84134-0100 Payment Coupon for Utah Withholding Tax.

Just in case you want to learn even more about Utah payroll taxes here are a few helpful links. What are the payroll tax filing requirements. Withholding Withholding Tax Payment Instructions Pay Utah withholding tax either.

More details about employment tax due dates can be found here. This must be completed for OnPay to be able to file and pay your Utah taxes. If you are required to make deposits electronically but do not wish to use the EFTPS.

Utah employers need to register for a withholdings tax account and an unemployment insurance tax account. Supplemental pay is an additional amount to regular pay separately stated and includes but is not limited to bonuses. Forms required to be filed for Utah payroll are.

Online at taputahgov through a bank debit e-check or a credit card or By mailing a check or money order payable to the Utah State Tax Commission along with the coupon below to. You may also mail your check or money order payable to the Utah State Tax Commission with your return. View All Claims Options.

This section discusses information regarding paying your Utah income taxes. Employers can register for both at the same time online using Utahs OneStop Online Business Registration application. Utahs Taxpayer Access Point.

File a Form 606 eResponse File a Form 613 or 613-R. Use the Online Penalty and Interest Calculator to calculate your penalty and interest or follow the instructions in Pub 58 Utah Interest and PenaltiesWe will send you a bill if you do not pay the penalties and interest with your return or if the penalty andor interest is calculated incorrectly. Please note that for security reasons Taxpayer Access Point is not available in most countries outside the United States.

Create a New UI Account For My Business. Utah Payroll Tax Resources. You will need to use Form 941 to file federal taxes quarterly and Form 940 to report your annual FUTA tax.

If you pay Utah wages to Utah employees you must have a Withholding Tax license. You may pay your tax online with your credit card or with an electronic check ACH debit. How did we do.

You have been successfully. 210 N 1950 W SLC UT 84134-0100. Visit Utahgov opens in new window Services opens in new window Agencies opens in new window Search Utahgov opens in new window Skip to Main Content.

Utah State Tax Commission. View History of 613 Responses. Rememberyou can file early then pay any amount you owe by this years due date.

If you are filing your return or paying any tax late you may owe penalties and interest. Utah State Tax Commission 210 N 1950 W SLC UT 84134-0100 Payment Coupon for Utah Withholding Tax. Please contact us at 801-297-2200 or taxmasterutahgov for more information.

WithholdingTax Payment Instructions You may pay your Utah withholding tax. Online at through a bank debit e-check or a credit card ortaxexpressutahgov By sending your check or money order payable to the Utah State Tax Commission along with the coupon below to. Employment Taxes and Fees.

You may pay your tax online with your credit card or with an electronic check ACH debit. You may also need. Funds Transfer EFT tax payment 11 Payment - single employer filing If you would like to pay your state unemployment taxes using Electronic Funds Transfer EFT during the regular online filing you will be asked to select Payment Method on Select Payment Method page by using the drop down box.

Withholding Tax Account Number. This is a tutorial to show how to setup Utah State Withholding to calculate in AMS Payroll. Scroll to the Utah Tax Setup headline and select Manage taxes.

You can pay online with an eCheck or credit card through Taxpayer Access Point TAP. Existing employers can find their Withholding Tax Account Number on Form A-1 Return of Income Withheld. Professional Licensing and Business Registration.

You may use this Web site and our voice response system 18005553453 interchangeably to make payments. Add An Existing Business To My User Account. Workers Compensation Coverage administered by the Utah Labor Commission.

Utah State Tax Commission 210 N 1950 W SLC UT 84134-0100 Payment Coupon for. This must be completed for OnPay to be able to file and pay your Utah taxes. It does not contain all tax laws or rules.

Filing Paying Your Taxes. Follow the instructions at taputahgov. You can also pay online and avoid the hassles of mailing in a check.

Your withholding is subject to review by the IRS.

What Is A Mortgage Loan Mortgage Loans Mortgage Home Mortgage

Income Tax Of India Income Tax Online Education One Liner

2021 Contribution Limits Increase For Utah Income Tax Credit Or Deduction

Utah State Tax Commission Official Website

Utah State Tax Benefits Information

New Jersey Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

Utah Sales Tax Small Business Guide Truic

Median Household Income And Taxes State Tax Levels In The United States Wikipedia Ricevimenti Valutazione

Free Utah Payroll Calculator 2022 Ut Tax Rates Onpay

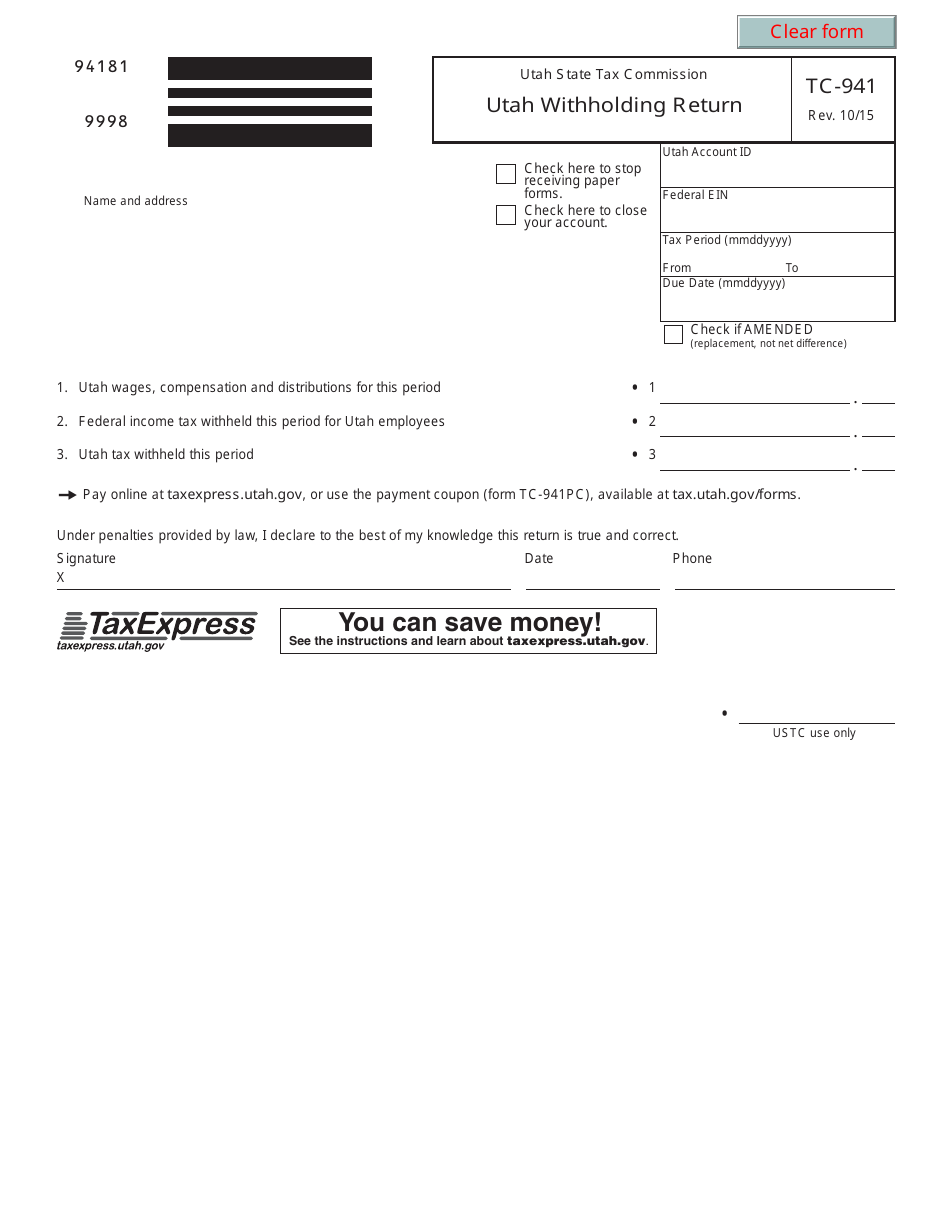

Form Tc 941 Download Fillable Pdf Or Fill Online Utah Withholding Return 2015 Templateroller

Utah State Tax Commission Official Website

Utah State Tax Benefits Information